Tennders x GrowthX- Monetization

B2B Logistics services and SaaS

Substitutes and pricing

Substitute | Type | Effort to use | Pricing | Core users | Primary Usecase |

Sennder | Digital Freight Forwarding | Medium 1. Only asset based companies permitted (brokers are banned) 2. Only marketplace, some integrations avaiable with enterprise TMS/WMS partners 3. No transparency, and layers of subcontracting | High, over 100k upto 2m | Users from large enterprises like Nestle, Geodis, Amazon,.. (usually an enterprise level acquisition) | 1. Sell all available shipments of the company (or, lanes/corridors) 2. Sell trucking services to Sennder 3. Timely payments |

Transporeon | SaaS and logistics service controller | Low 1. Complete handover of information and decision cycles 2. Review and support available for premium enterprise users | High, over 350k | Users from large enterprises like Adidas, GaladTrans, DHL, Amazon,.. (usually an enterprise level acquisition) | 1. Complete handover of logistics to tools and services of Transporeon 2. Transparency |

Wtransnet | Marketplace | High 1. Marketplace with too many companies 2. No filteration, too many fraudulent entities 3. Buyer reposts deal on same marketplace to subcontract 4. No integrations available | Medium, 5000 per month for 5 users | Logistics SMEs and brokers from over 100k companies | 1. Post shipment and trucks 2. Negotiate deals and re-sell |

TransEU | Marketplace | High- same as Wtransnet 1. Marketplace with too many companies 2. No filteration, too many fraudulent entities 3. Buyer reposts deal on same marketplace to subcontract 4. No integrations available | Low, 119 per user per month | Logistics SMEs and brokers from over 100k companies | 1. Post shipment and trucks 2. Negotiate deals and re-sell |

are

- Retention: Each month, groups of users from SMEs and Large enterprises join Tennders, either on SaaS or Marketplace.

- Deeper Engagement: Most of the user base is paid users on Internal (10%), Marketplace(20%) and SaaS(40%), where user segments are core and power.

Free users categories - SaaS buyer enterprises- Enterprises buying SaaS solution, get to onboard 'x' number of users for free to digitize their partners/providers on their operating environment (provided by tennders)

Note: The same free users can also have access as free users on the general marketplace. - Marketplace- Users from various companies can join the marketplace to post their shipment and truck requirements.

- SaaS buyer enterprises- Enterprises buying SaaS solution, get to onboard 'x' number of users for free to digitize their partners/providers on their operating environment (provided by tennders)

- Willingness to pay:

- SaaS: willingness to pay is very high, considering the pricing is relatively low for the value offered. The time to onboard is long as the decision cycle to acquisition is high with low flexibility.

- Marketplace: willingness to pay is medium/decent, as most marketplaces charge over 10x more than Tennders.

What are users willing to pay?

- B2B logistics has high capacity to pay for services which is marginal(0.1% - 1%) wrt to price of goods. Companies pay upward of 10k per user per annum for digital and networking services.

Would you be willing to pay recurring or just once?

- Recurring, as long as services are delivered as per expectations.

What would make you pay more?

- For reducing effort and increasing trust and transparency.

Who to charge?

Write the core value prop of your product?

- Core value is logistics services that is simple and digitised. It simplified work of buyers and their partners/providers without any extra cost.

Write how your users experience this core value prop?

- Posting shipments/truck requirements, negotiating offers, making deals for transactional and bulk/contract shipments.

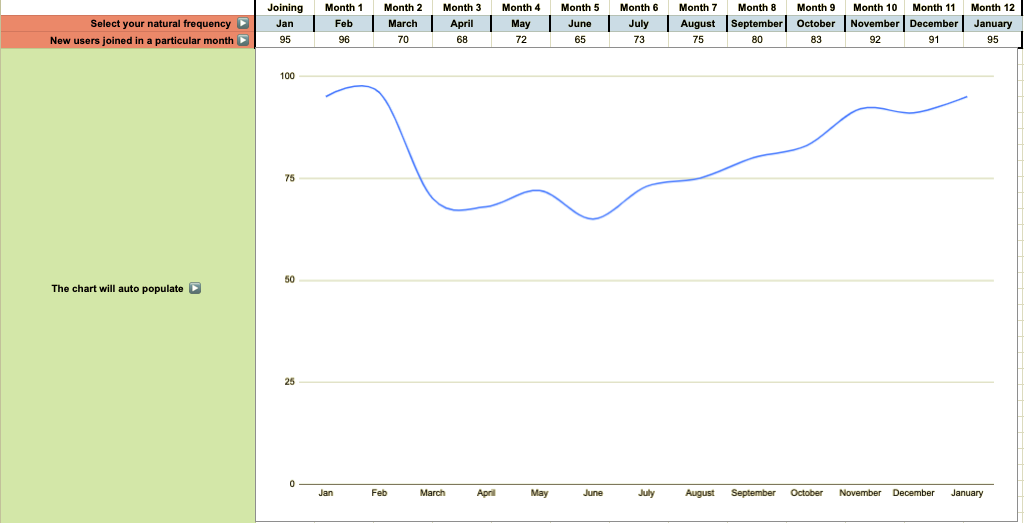

Write the natural frequency of your product?

- Daily

Segment users into champion, loylists & potential loylists

- Champion: SaaS power users who spend 6hrs per day on Tennders to transact all aspects of their work and business.

- Loyalists: SaaS core and power users who use Tennders SaaS to onboard and digitize their partners/providers.

- Potential loyalists: Marketplace users who are consistently buying services and making bookings/deals.

Perceived Value:

Step 1 → Define your product’s perceived value

- Efficiency (with access to a network and simplified processes)

- Time (New partners/providers)

- Dopamine and money (sales activity is a high dopamine environment, deals brokered (with monetary gains and sometimes even a solution to a problem boosts dopamine)

Step 2 → Write the inflection point

- Day 1: 1 post made

- Day 1: offers received (aha!!)

- Day 1: Deal confirmed and documentation generated

- Day 2: 5 posts made (inflict limitations of free usage, 5 posts per week)

- Day 2: permit only 4 out of 5 posts, negotiate, make deals

- Day 2: push to pay for service to post more than 5 posts per week

Note: in B2B logistics, the 'offer' to 'confirmed deal' lifecycle can range from 1 minute to 2-3 weeks, depending on various factors like price, corridor, shipment type, truck type, and driver preferences.

What to charge for?

Time:

- SaaS: companies are charged annually

- Marketplace: companies/users are charged per month

Access:

- SaaS: companies are charged for services they pick per group of users like mini-tender, private marketplace, QuickPay

- Marketplace: companies/users are charged based on the number of posts they can make per week and features as add-on

Step 1 → Write the core value prop of the product.

- Product currency is by gaining trust: 'experience ratings' generated by product and 'trust badges' given by partners/providers on transactions for exceptional service provided can be used to have preferred access to clientele/providers.

Step 2 → Write the action by which they expereince the core value prop

- Transparent and informative posts that converts into deals

Step 3 → Write what will you charge them for?

- Access: access to services, tools and network.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.